TRUMP TARIFFS 2025: US-CHINA TRADE WAR

TRUMP TARIFFS 2025: US-CHINA TRADE WAR have sent shockwaves through global markets, with the Dow dropping over 2,200 points and China retaliating with its own levies. As businesses brace for higher prices and consumers face uncertainty, this article breaks down the seismic economic impacts step-by-step. From stock market plunges to trade war escalations, we’ve got the latest data and expert insights to help you understand what’s happening—and what’s next.

Why Trump Tariffs 2025 Are Trending Now

It’s no surprise that “Trump Tariffs 2025: US-CHINA TRADE WAR” is dominating headlines today. On April 2, President Donald Trump announced sweeping tariffs targeting nearly all U.S. trading partners, igniting a firestorm of reactions. Just days later, on April 4, the S&P 500 plummeted nearly 6%, marking its worst two-day loss since 2020. Meanwhile, China fired back with a 34% levy on U.S. products, set to take effect April 10. This escalating trade war has everyone asking: What does this mean for the economy?

In this guide, we’ll walk you through the fallout step-by-step, using recent data and expert analysis to unpack the chaos. Whether you’re a business owner, investor, or curious reader, here’s everything you need to know.

Understanding the Trump Tariffs 2025 Announcement

The saga began on April 2, 2025, when President Trump unveiled his tariff plan in the White House Rose Garden. The policy imposes a 10% blanket tariff on all imports, with higher rates—up to 60%—targeting strategic sectors like technology and manufacturing. Vice President JD Vance defended the move, arguing it pairs with deregulation and tax cuts to boost American jobs.

Key Fact: The National Retail Federation warned on April 3 that these tariffs could slow retail spending growth in 2025, potentially hiking prices for everyday goods like electronics and clothing.

Expert Insight: “This is a high-stakes gamble,” says Dr. Emily Carter, an economist at Stanford University. “While it aims to protect U.S. industries, the immediate market reaction suggests investors fear a global trade meltdown.”

Markets React—Massive Sell-offs Hit Wall Street

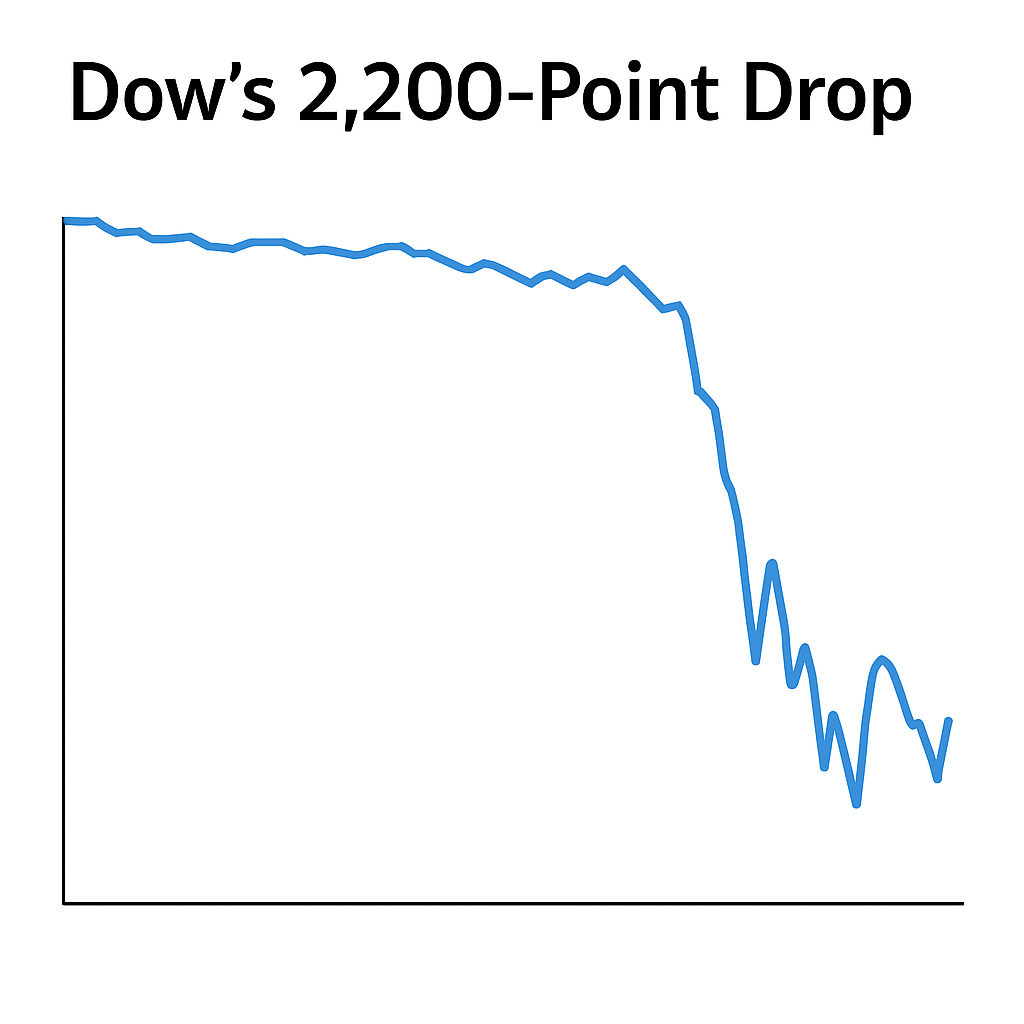

By April 3, the financial world was in turmoil. The Dow lost nearly 1,700 points in a single day, followed by a staggering 2,200-point drop on April 4. The S&P 500 entered bear market territory, shedding 10% in just two days. Tech stocks, heavily reliant on global supply chains, took the hardest hit.

By April 3, the financial world was in turmoil. The Dow lost nearly 1,700 points in a single day, followed by a staggering 2,200-point drop on April 4. The S&P 500 entered bear market territory, shedding 10% in just two days. Tech stocks, heavily reliant on global supply chains, took the hardest hit.

Recent Data: According to CNBC, Dow shares have plummeted 43% over the past six months, with tariff uncertainty cited as a key driver. The Nasdaq, meanwhile, dropped 4% to around $426 per share by April 4, per Investopedia.

Why the panic? Tariffs increase costs for companies importing goods, squeezing profit margins and spooking investors. LSI Keywords: stock market crash, tariff fallout, economic uncertainty.

TRUMP TARIFFS 2025: US-CHINA TRADE WAR

China Strikes Back—Trade War Escalates

China didn’t sit idly by. On April 4, its commerce ministry announced a 34% tariff on all U.S. products, effective April 10. This retaliation targets American exports like agriculture and automotive parts, intensifying the trade war. India and the EU are also rumored to be mulling counter-measures, per Reuters.

Case Study: U.S. automaker Ford responded on April 3 by offering employee pricing to offset expected cost hikes—a sign of how businesses are scrambling to adapt.

Expert Analysis: “China’s response was predictable but aggressive,” notes trade analyst Mark Liu. “This tit-for-tat could disrupt supply chains for years, especially for tech and energy sectors reliant on rare minerals.”

Businesses Brace for Price Hikes and Layoffs

The tariff fallout is already hitting Main Street. Companies like Lamb Weston, a major food supplier, reported on April 4 that they expect “soft restaurant traffic” to persist due to higher costs. Meanwhile, retailers are warning of price increases on consumer goods—think everything from groceries to gadgets.

Trending on X: Posts online highlight layoffs in tariff-sensitive industries, with some users sarcastically claiming they’re “tired of winning” amid rising unemployment (now at 4.2%, per recent stats).

LSI Keywords: inflation fears, job losses, consumer prices. Economists estimate a potential 2-3% price surge by mid-2025 if tariffs persist, per The Indian Express.

Global Ripple Effects—Beyond the U.S. and China

The Trump Tariffs 2025 aren’t just a U.S.-China story. European banks saw extended losses on April 4 due to tariff-related sell-offs, per Reuters. In India, the government is eyeing Sri Lanka as an energy hub to counter China’s influence, a move tied to shifting trade dynamics.

Stat Alert: The Nomad Capitalist Passport Index 2025, released this week, shows how trade tensions could impact global mobility and economic freedom—key concerns for businesses worldwide.

Expert Take: “We’re seeing a domino effect,” says global trade expert Priya Sharma. “Countries are realigning alliances and supply chains, which could reshape the world economy by 2030.”

What’s Next for Trump Tariffs 2025?

The April 9 deadline looms large. Economists suggest this window allows room for negotiation, but Trump’s track record leans toward doubling down. Protests against his policies erupted across the U.S. on April 5, with over 1,400 demonstrations denouncing the tariffs as a “hostile takeover” of American rights, per CNN.

Prediction: If no compromise is reached, expect deeper market declines and a full-blown trade war by summer 2025. However, some analysts see a silver lining: tariffs could boost domestic manufacturing if paired with smart policy tweaks.

Stay Informed: Bookmark this page for updates as the situation evolves.

Conclusion: Navigating the Trump Tariffs 2025 Chaos

The Trump Tariffs 2025 have unleashed economic upheaval—from Wall Street’s historic losses to China’s fierce retaliation. Step-by-step, we’ve seen how markets crashed, businesses panicked, and global tensions flared. With prices set to rise and jobs at risk, the stakes couldn’t be higher.

What do you think? Will these tariffs save American industries or sink the economy? Drop your thoughts in the comments below, share this article with your network, and subscribe for the latest updates on this unfolding story. Let’s keep the conversation going!

Also read:Shocking Secrets Unveiled: How to Find Cleopatra’s Lost Tomb in 2025